As the pioneering Islamic financial consultancy entity in Bangladesh, we are pleased to present our specialized Zakat services tailored to both personal and corporate needs.

Personal and Corporate Zakat Calculation

-

- – Comprehensive assessment of both short- and long-term debt deduction eligibility.

-

- – Accurately identifying Zakatable assets from the Company’s balance sheet -Cash reserves, investments, inventory, receivables, etc.

-

- – Incorporating various types of reserves, provisions & other complex issues in the calculation in light of international Shariah standards.

-

- – Utilization of in-house Shariah scholars with CSAA degrees and international exposure.

Importance of Zakat in Corporate Environment & the Proper Calculation of It

Although Zakat is among the five pillars of Islam, it’s sometimes neglected within our corporate environment. It’s essential to remember that the deprived have rights even in the wealth of business entities.

Allah Subhana Tawala mentioned in the Quran:

“O you who believe! Spend out of what We have provided you before there comes a Day when there will be no buying and selling, nor will friendship and intercession be of any avail.” (Al-Baqarah- 2:254)

And also

“And in their wealth, there was a right for the petitioner and the deprived.” (Quran, Adh-Dhariyat 51:19)

We have to keep in mind that ‘Zakat is a farz Ibadah’. Therefore If Zakat isn’t calculated correctly, one of our most vital religious responsibilities may become incorrect and incomplete.

Confidentiality and Non-Disclosure

Your Information is 100% Amanah to us.

At IFAC, we understand the sensitivity of financial information. We assure you that your confidential data is safe with us. Our professional handling of every aspect is backed by our commitment to client confidentiality. Our service agreement includes robust Non-Disclosure Agreement (NDA) clauses, ensuring that your financial information remains secure and protected.

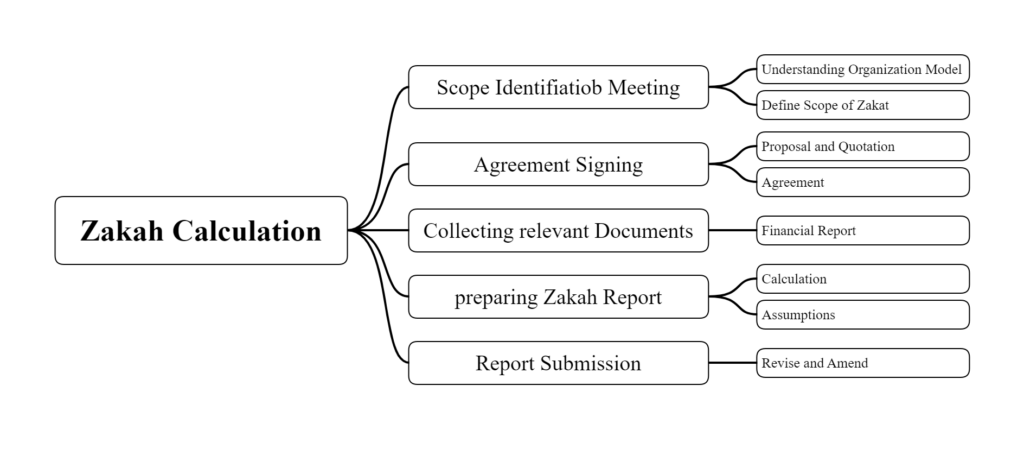

Work Process