Certificate Course In Islamic Banking

Introduction

Islam is a complete way of life, encompassing guidance for all aspects of human existence. From family to society and state affairs, it provides comprehensive regulations. In the realm of economics, Islam offers a well-structured financial system, known as Islamic Banking, which is based on Shariah principles.

Over time, the banking sector has evolved with new features and modes. Contemporary scholars have analyzed these developments from an Islamic perspective, contributing to international forums and resolutions to ensure financial practices align with Shariah. This promotes the socio-economic well-being of humanity in a holistic manner.

To raise awareness about Islamic banking and address questions and misconceptions, we are organizing the Certificate Course in Islamic Banking (11th Batch). This course aims to provide comprehensive knowledge of ideal Islamic banking, exploring its principles and applications.

May Allah guide us in aligning our lives with Shariah principles. Ameen.

FAQ

- Students of finance and economics.

- Individuals involved in Islamic banking operations.

- Scholars and Muftis specializing in Islamic jurisprudence and fatwa issuance.

- Aspiring professionals aiming for careers in Islamic banking.

- General audiences interested in understanding Islamic banking.

- To provide a clear understanding of the history of banking and Islamic banking.

- To clarify Shariah guidelines related to banking.

- To explain the principles of Shariah-compliant contracts.

- To offer insights into Islamic banking investments and liabilities.

- To explore Islamic banking practices globally and locally.

- To present a Shariah-compliant framework for an ideal Islamic banking system.

- Expert Trainers:

Trainers with advanced degrees in Islamic jurisprudence from renowned Darul Ifta institutions and certification as Shariah advisors and auditors (CSAA) from AAOIFI. - Practical Approach:

Each session includes real-world case studies and practical examples. - Modern Presentation Methods:

Interactive sessions supported by visual aids like slides. - Dedicated Q&A Segment:

Each session includes a dedicated 15-minute Q&A to clarify concepts.

Course Details

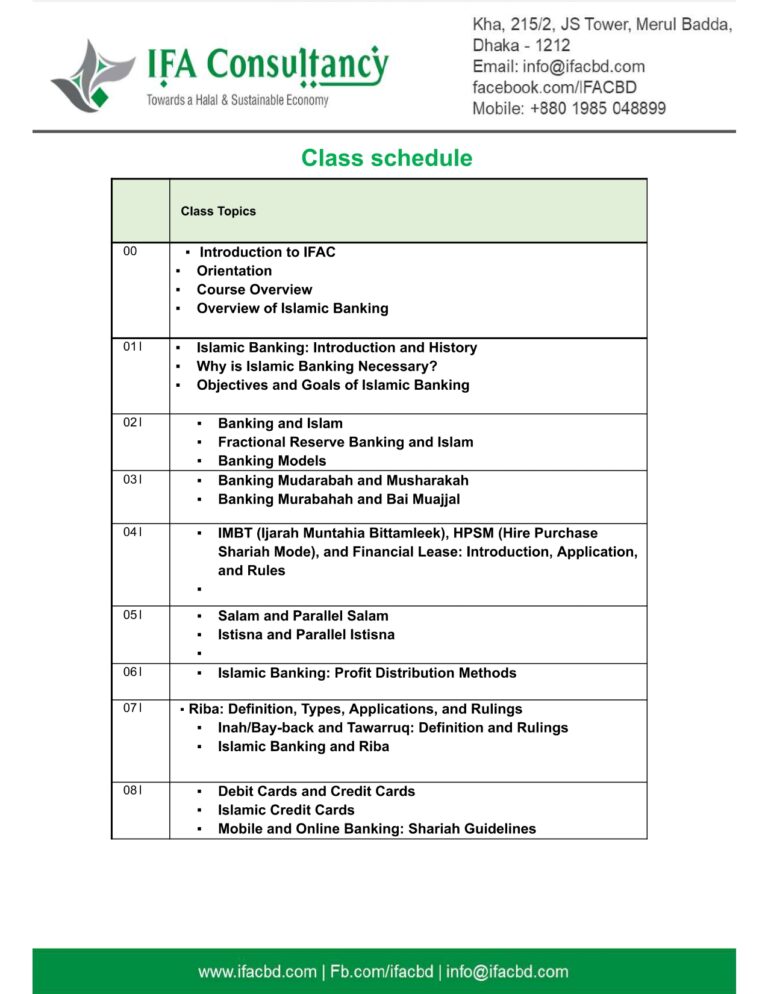

- Total Classes: 10

- Duration of Each Class: 1.5 hours (1 hour 15 minutes for the main session and 15 minutes for Q&A).

- Mode of Instruction: Online

- Course Start: 2/5/2025

This comprehensive course will equip participants with the knowledge and skills needed to understand and apply the principles of Islamic banking effectively.