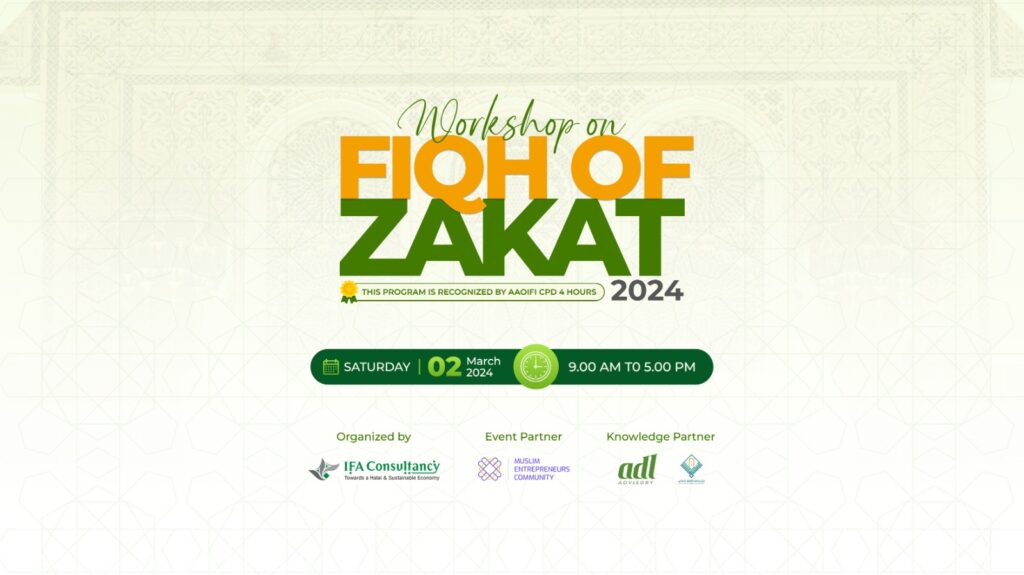

🗓️ Date: March 2, 2024

⌛ Time: 9:00 AM – 5:00 PM

🏟️ Venue: TCB Bhaban Auditorium, Karwan Bazar, Dhaka.

For AAOIFI Fellows: 40% Discount = 600BDT

For MEC Members: 40% Discount = 600BDT

For University Student: 50% Discount = 500BDT

For inquiries and additional information, please contact

👤 Fahim Faysal Al Masud, CSAA

📞 01638049129

📩 faysal@ifacbd.com